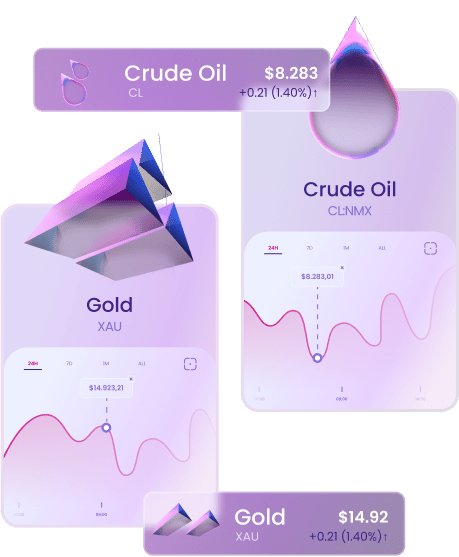

Commodities (Gold & Crude Oil Investment)

The commodities market is broadly categorized into metals, energy, livestock & meat, and agricultural products. Among these, gold and crude oil remain two of the most sought-after assets for investors worldwide due to their historical value and global deman.

Investing in commodities such as gold and oil through CFDs offers a strategic opportunity to diversify your portfolio and hedge against market volatility. With Traze, you can gain exposure to these key assets and potentially enhance your returns with minimal capital. Start your investment journey with confidence — open an account today.

What Are Commodities?

Commodities are fundamental raw materials that drive the global economy. They are typically classified into four main categories: metals, energy, livestock & meat, and agriculture.

Examples include crude oil, natural gas, gold, and silver — all of which are widely recognized for their intrinsic value and consistent demand. Among them, gold and crude oil are the most actively traded due to their economic significance and market liquidity.

While commodities like gold are often viewed as stable stores of value, others like oil are more volatile, frequently influenced by geopolitical developments. This dynamic nature makes them attractive to both investors and strategic traders seeking portfolio diversification and growth opportunities.

| Stock | 52 Week Range | Chart (24H) |

|---|---|---|

Gold vs US Dollar XAUUSD | ||

Silver vs US Dollar XAGUSD | ||

Platinum US Dollar XPTUSD | ||

Palladium US Dollar XPDUSD | ||

Natural Gas NG | ||

Brent Oil UKOIL | ||

Copper COPPER | ||

Coffee Arabica CoffeeAr | ||

US Corn Corn | ||

US Cotton Cotton_* | ||

Sugar No. 11 SugarRaw |

Advantages of Investing in Commodities

- Diversify your portfolio: Investing in commodities is an effective way to hedge against fluctuations in stocks and bonds, helping you build a more balanced and resilient investment portfolio.

- High Growth Potential: The commodities market is dynamic and influenced by global factors, offering investors frequent opportunities for substantial returns.

- Inflation Protection Commodities like gold and crude oil tend to hold or increase their value during inflationary periods, making them a strong defense against rising prices.

Commodity Investing FAQ

A CFD (Contract for Difference) is a financial instrument that allows you to speculate on the price movements of commodities like gold and crude oil without owning the underlying asset.

You can invest in CFDs based on either the spot price—the current market price—or the futures price of a commodity. For example, gold CFDs often come in standard contract sizes such as 10 or 100 ounces, with mini contracts available for smaller investors (typically 1/10th the size).

When you invest in a commodity CFD, your profit or loss depends on how much the asset's price moves from your entry point. Since CFDs are leveraged products, you can control a larger position with a smaller amount of capital—sometimes with as little as 3% margin. For instance, with 1:10 leverage, you only need to commit 10% of the total value of the investment.

Keep in mind that holding a CFD position overnight usually incurs interest charges, similar to borrowing funds from your broker to hold the asset.

When investing in commodities like gold or silver, you can choose between CFDs (Contracts for Difference) and Futures. Both are derivative instruments, meaning they let you speculate on price movements without owning the physical commodity.

Futures Contracts

Futures are standardized agreements where one party commits to buy or sell a specific quantity and quality of a commodity at a predetermined price on a set future date. While these contracts are technically designed for physical delivery, in practice, most investors close out their positions before delivery occurs.

Futures are typically traded on margin, which amplifies both potential gains and risks. Because they are closely tied to real-time market pricing, futures can be highly volatile, making them ideal for experienced investors comfortable with high risk and reward.

CFDs (Contracts for Difference)

CFDs represent an agreement between you and a broker to exchange the difference in the commodity's price from the time the position is opened to when it’s closed. You never own the asset — you're simply speculating on price changes.

CFD investing is popular due to its flexibility and liquidity. You can enter or exit positions quickly, even with large amounts, and often with lower capital requirements thanks to leverage. This makes CFDs more accessible and appealing to individual investors seeking exposure to commodities.

Investing in commodities like gold, crude oil, and other assets can seem overwhelming for beginners — but Minxson is built to simplify the process.

Straightforward Entry for New Investors

Minxson provides a clear, user-friendly interface and step-by-step guidance, making it easy for newcomers to start investing in top-performing commodities.

Educational Support and Resources

Our platform offers easy-to-understand educational materials that help you understand market trends, risks, and strategies — so you can invest with greater confidence.

Smart Tools to Guide Your Journey

Minxson integrates AI-powered tools and real-time market insights, helping you make informed decisions across gold, oil, and other key commodity sectors.

Start your commodity investment journey today — confidently and securely — with Minxson.