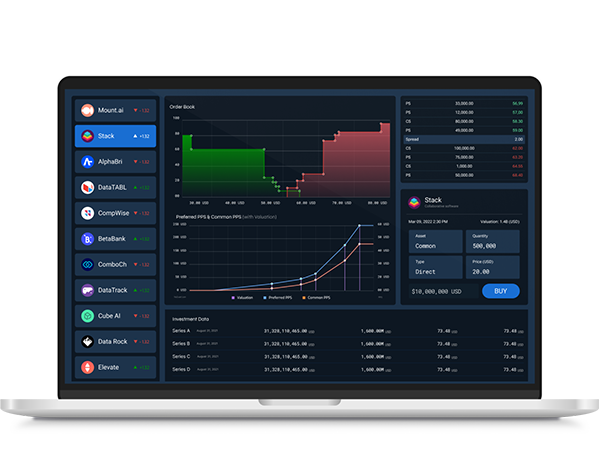

Minxson Growth

Growth Equity Reimagined®: Through revenue acceleration opportunities, operational support and access to Minxson’s unparalleled resources, we’re redefining growth equity.

Strategic Product Allocation at Minxson

At Minxson, we’ve built an investment model grounded in multi-asset allocation and intelligent diversification to ensure both stability and performance for our investors. Rather than relying on a single asset or sector, all investment products on Minxson are strategically distributed across different product categories, each offering unique market behavior, risk levels, and return potential.

Multi-Layered Investment Structure

Minxson’s AI-powered engine manages investments across multiple financial verticals:

Forex (Foreign Exchange)

The world’s most liquid market, ideal for short-term gains through currency pair fluctuations and hedging strategies.

Cryptocurrency

A highly volatile but high-growth sector, offering opportunities through staking, spot positions, and momentum-based strategies.

Shares (Equity Investment)

Exposure to established and emerging companies, including innovation-driven firms like Tesla and tech-sector giants.

Indices

Broader market exposure through index baskets (like the S&P 500, NASDAQ, and FTSE), ensuring portfolio balance and reducing single-stock risk.

Commodities

Including gold, crude oil, and agricultural assets—commonly used as inflation hedges and for diversification in volatile times.

Futures Contracts

Enabling advanced speculation on future price movements of assets like oil, metals, indices, and more, with leveraged opportunities.

CFDs (Contracts for Difference)

Allowing investors to trade price movements without owning the underlying asset, offering margin efficiency and liquidity.

AI-Staking Protocols & Yield Optimization

Using real-time market data and blockchain-backed staking platforms to generate passive income.

Consistent ROI Through Diversified Exposure

By allocating investor funds across these diverse financial instruments, Minxson is able to:

Generate multiple streams of daily ROI, each from a unique asset category or strategy.

Mitigate market-specific risk, since a downturn in one sector (e.g., equities) is often balanced by strength in others (e.g., commodities or Forex).

Enhance capital efficiency by rotating capital between short-term and long-term strategies across product classes.

This non-linear profit model is core to how we deliver consistent, resilient returns without depending on the performance of just one investment product or market condition.

⚙️ AI-Guided Portfolio Management

Minxson’s in-house algorithms and predictive analytics ensure that:

Capital is dynamically allocated based on market momentum, volatility index readings, and asset correlation metrics.

Investment positions are rebalanced automatically, reducing exposure in overheated markets and increasing participation in emerging trends.

Investor portfolios benefit from compound growth opportunities, driven by real-time reinvestment decisions.

🌐 Why This Matters for Investors

Whether markets rise, fall, or move sideways, Minxson’s diversified structure ensures that your investment is always working — across sectors, across timelines, and across global opportunities.